I am a sucker with it comes to budgeting in detail. The 5 minutes of figure plucking excitement nearly always ends in frustration to see that the actual figures do not go as plan. Since I am one of those who is afraid to overspent, do I really need a budget?

“If you fail to plan, you plan to fail” – Benjamin Franklin

Having no hard commitments, I may not need a budget yet, but budgeting is a habit that we all have to develop before any crisis “flood” arise. As I try to adopt one of the easiest budgeting concepts, I realize I never really understood the need for a budget, before, but it’s such a great blueprint to help me set a pathway in managing my finance month by month.

If you have never done budgeting, all it takes is 10 minutes read and a lifetime of implementation.

A wise couple taught me this in my mid 20’s and I am striving to get closer step by step, stress-free. Last month, we even have a financial planning sharing on this where I withness one of my best friend finally called-in to cut her ASTRO (cable TV) subscription and we pop-open a sparkling wine to celebrate that. Money is a sensitive issue but it could also be fun.

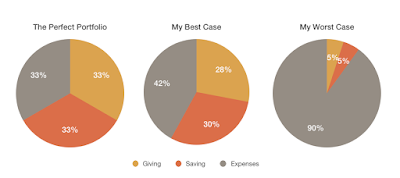

This is how the budget works. It’s just a simple portfolio with 1/3 to giving, 1/3 to savings and 1/3 to expenses. In fact, that is all we need to know about budgeting and reverse engineer our figures into the pie.

The allocation varies with the season but basically, that’s the budget blueprint, my financial goal to attain month after month. Sometimes I have more obligations or fewer earnings, so the allocation swings but I always try to balance it on a yearly view.

Giving- 33%

By giving, I don’t mean by upright monetary giving, I believe that would be rather impossible for me and most of us. Giving should be stress-free, give as a cheerful giver. First and foremost, it’s tithing. And that’s 10%. If you aren’t a Christian, congrats, you have extra 10%. For me, the love God gives and things He has done for me is greater than the 10% I could give.

The remaining includes all the offerings, sponsorship, celebrations, friend birthday invites, pot bless, charitable events etc. You could even buy yourself a birthday gift.

Saving -33%

Savings includes all assets. If you have basic medical and accidental insurance, you don’t need to keep too much cash. Installment for a house should come here since we have a long-term appreciation view of assets. The financing interest, however, falls under expenses.

Expenses-34%

Expenses is a tricky one. How could we keep our expenses below 40% of our income, particularly if you live in the city? Track your spending, keep your commitments low, and your expenses lower.

My cousin still manages to get by about RM1,300-1,500 (USD$450) a month in KL now. I would conclude that spending only 40% is not easy but attainable.

i. Track your spending

Why tracking works? The main reason that we overspend with credit cards but never with cash is that it’s designed to make us feel like the cost of our spending habits is not ours to pay. The monthly repayment is so low that it’s looks attainable.

When you hold a Citibank card, they will SMS you an offer to convert your balance into payment plans RIGHT after purchase and BEFORE the statement comes. These purchase are like magic – now you see me, now you don’t. This looks-real-illusion make spending look simply so affordable.

However, if you are willing to input on your phone every time you spend, trust me you WILL fell the stress when the numbers creep up early of the month.

ii. Keep your commitments low

Always keep your commitments low if you want a stress-free life. Expensive subscription or membership should go.

Can’t hit the gym? Walk in the park, self-plank at home.

High speed internet? Share with a neighbor that you trust. Don’t know your neighbors? Say hi to them next time you see them.

Friends that cannot accept your frugality? Ask yourself if you are willing to trade your financial freedom for them.

ii. And your expenses lower

There are a lot of ways to live DE LIFESTYLE and yet not ruin your wallet.

If you need to go a café, opt for the cheapest muffin or a can drink. (It’s a secret, but I still shamelessly hang out café for free sometimes.)

If you need to watch movie at the cinema, go on movie club day or score free passes.

If you need branded bag, thrift or wait for sales.

Then there are things that you should avoid at all cost

- Spending beyond your income with credit card, soon the interest will bring you depression.

- Quick rich scheme, it’s a real life temptation but you never know when you will wake up with your money gone.

- Bank guarantor, sometimes unavoidable but not that wise unless you are willingly sponsoring.

If you haven’t been able to do budgeting or track your expenses for the matter, what’s holding you back?