There is no doubt that driving a new car is a happy event in our life (if you aren’t happy you could give it to me) – until the 13th month where the car celebrates 1 year old and we still paying the same high installment from day 1. Cars in Malaysia are rather affordable – not cheap definitely but easily purchase with loans. And we don’t have access to quality mass transit – unless you work and stay beside the public transit.

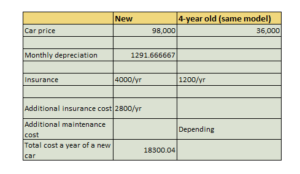

I need a car to travel back and forth two cities and was torn between choosing between new or old car of the same model. Yes, I could probably afford the new car loan with some life sacrifice, but could I afford the depreciation cost? I made the choice based on what I think is the true cost of owning a new car.

If I take a 9-year loan on a new RM100k car, the repayment is about RM1,000, something I might afford. But in actual, the car is costing me RM18,000 a year or RM1,500 a month before gas and toll, regardless if the loan repayment is lower or higher.

That is what I call true cost analysis. If the cost of a new car is something you can afford with honest money- then great joy, by all means, buys the car. If not, you should consider getting an old car even if you can pay the monthly installment because it’s going to hurt your wallet down the road.