Is November gone already? It feels decidedly month 11th. I’ve stressed over all the presentations, assessment and project and when I could breathe the November air, it’s already December!

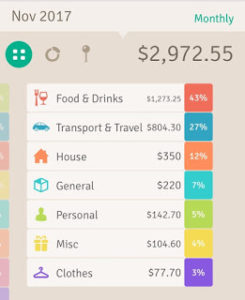

And the month spending is relatively low. I already exceed this figure for December as of today (it’s Christmas). Is being busy is key to spending less? November is all about 20% off petrol cards and dining out + grocery shopping. It also appears that I have a penchant for peeking into the tracking app all the time like it would make me wiser. Sometime the numbers seem right, and it makes me order another glass of wine or tea.

The rise of subscription model and the threat to my spending is real. I am so outdated that I got no subscription to Netflix, iFlix or Hula…yet, my yearly subscription bill cost comes to RM3500. Apps that cost, web hosting, service and broadband subscription. These things add up.

Dec Goals

Life without facials

What we think we absolutely need may not be something we actually need. Can a scrub + mask save me a $1000? (Never mind if the scrub is $100) I know, it’s is a lot of hassle to do it myself but gone are the days I want to see installment on the credit card.

Stay healthy and fit

7-minute exercise app by Johnson & Johnson (Free)

Chasing the numbers

Unit trust: An additional RM1,000 in November. But I am undecided about funding the private retirement scheme.

Little things in Malaysia

I do find it odd that our inflation has gone up much but base lending rate is not raised. We all know that there are property overhang but not rising BLR when inflation is picking up – is that a sign that rate of non-performing loan is picking up?